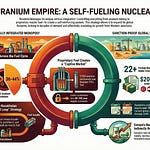

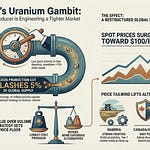

In this episode of the Uranium Unleashed audio podcast, we examine Kazakhstan’s strategic shift toward a "value over volume" model and its impact on the global uranium market. By implementing production cuts and enacting stricter subsoil laws, the state-owned producer Kazatomprom is consolidating control over supply and acting as a price maker similar to an OPEC member. This legislative and operational discipline reduces global primary supply, creating a bullish pricing environment that benefits alternative producers in Namibia, Canada, and Australia. While these shifts increase costs for global utilities, they incentivize capital investment in higher-cost regions to bridge the growing supply gap. Ultimately, it describes a structural repricing of uranium driven by sovereign control, rising nuclear demand, and a move toward market-centric supply discipline.

How One Country's Big Decision Affects a Global Price: The Story of Uranium

Kazakhstan Becomes the OPEC of Uranium

Feb 09, 2026

Uranium Unleashed Podcast

Strategic intelligence on global uranium and copper markets—institutional-grade insights on project development, industry catalysts, and market dynamics from over 20 years of international mineral exploration experience

Strategic intelligence on global uranium and copper markets—institutional-grade insights on project development, industry catalysts, and market dynamics from over 20 years of international mineral exploration experienceListen on

Substack App

RSS Feed

Recent Episodes