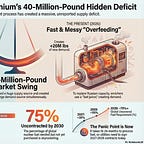

The episode examines a critical uranium supply crisis projected for 2026, driven by a "contracting cliff" and hidden industrial inefficiencies. Utilities face massive uncovered fuel requirements as old contracts expire, while geopolitical shifts, specifically the move away from Russian enrichment, have forced Western facilities into a "fast and messy" process known as overfeeding. This technical shift creates "ghost demand," requiring significantly more raw uranium to produce the same amount of fuel, effectively erasing years of secondary supply. Experts highlight a major reporting gap, noting that standard models fail to account for this 40-million-pound market swing caused by enrichment bottlenecks. Consequently, while spot prices may seem stable, long-term contract prices are rising as major producers like Cameco and Kazatomprom struggle to meet the surge in volume. This leaves Western-aligned miners and conversion facilities as the pivotal gatekeepers for global nuclear energy stability.

The 40-Million-Pound Ghost: Why Uranium's Real Deficit is Invisible

a 40-million-pound swing—equivalent to two of the world’s largest mines disappearing overnight

Jan 29, 2026

Uranium Unleashed Podcast

Strategic intelligence on global uranium and copper markets—institutional-grade insights on project development, industry catalysts, and market dynamics from over 20 years of international mineral exploration experience

Strategic intelligence on global uranium and copper markets—institutional-grade insights on project development, industry catalysts, and market dynamics from over 20 years of international mineral exploration experienceListen on

Substack App

RSS Feed

Recent Episodes