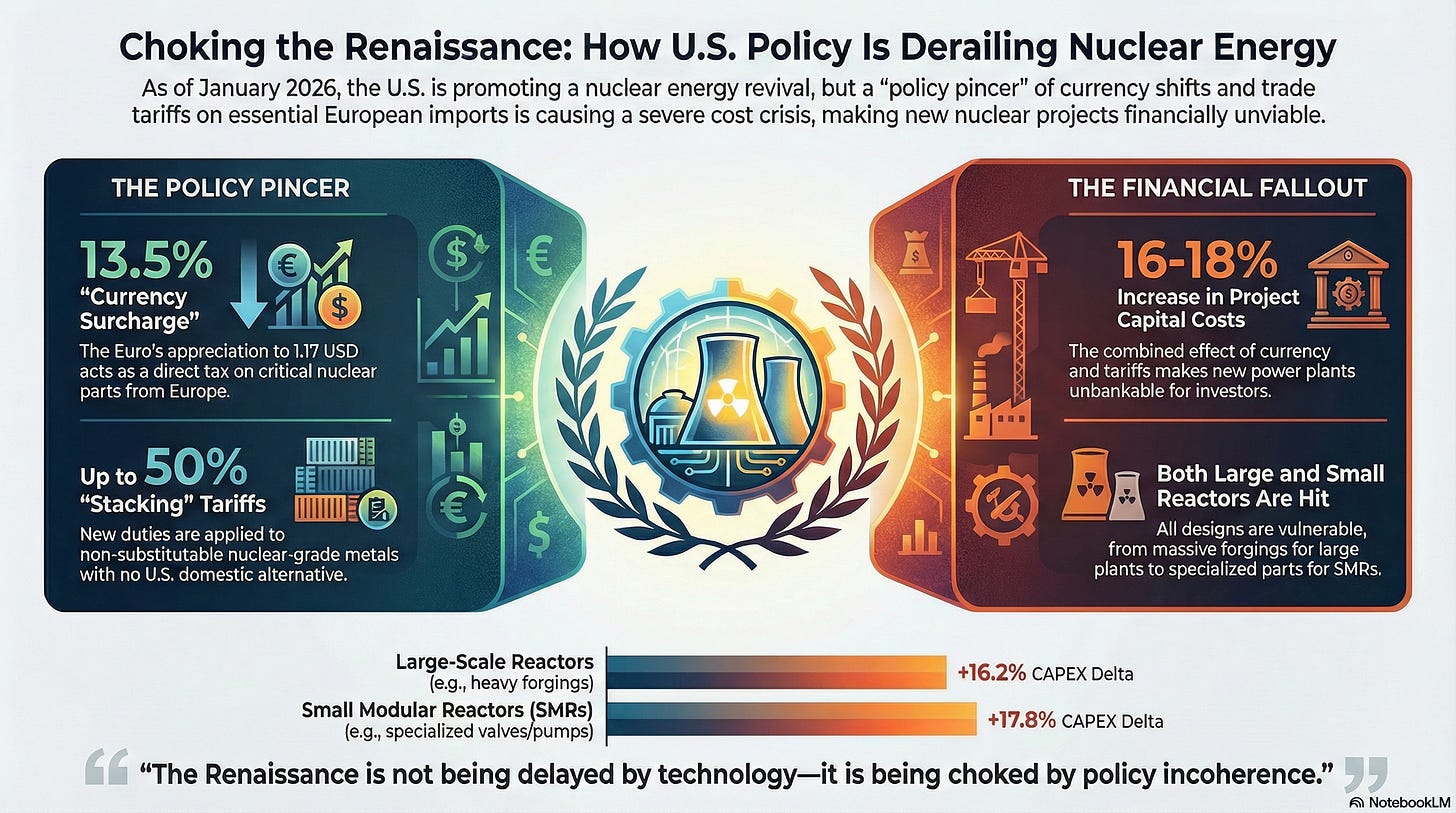

Understanding the “Policy Pincer”: Why Building New Nuclear Power is Suddenly So Expensive

Introduction: The Blueprint for a Problem

Imagine you’ve drawn up the perfect blueprint for a dream house, planning to use special, high-performance windows and steel beams from top European manufacturers. Suddenly, your project is hit by a self-inflicted crisis: the currency of the country where you buy your materials has gotten much stronger, and your own government has just placed a heavy, unavoidable tax on those exact imported components. Your dream house is now being systematically dismantled on the drafting table. This is precisely the paradoxical situation choking the U.S. plan for a “nuclear renaissance” in early 2026.

This explainer will break down two key economic challenges that are making new U.S. nuclear projects prohibitively expensive: a rapidly changing currency exchange rate and the imposition of compounding import taxes, or tariffs. Together, they have created a crisis that industry analysts are calling the “Greenland Surcharge.”

These challenges are not theoretical; they are actively squeezing the financial viability out of new clean energy projects. Let’s start with the first, more subtle challenge: the rising cost of foreign currency.

1. The Currency Challenge: A Price Hike in Disguise

At its core, a currency exchange rate is simply the “price” of another country’s money. The Euro/U.S. Dollar (EUR/USD) rate, for example, tells an American company how many dollars it must spend to buy one euro. A small change in this rate can have massive consequences for large-scale projects.

In early 2025, one euro cost about 1.03. By January 2026, that same euro now costs 1.17. This represents a 13.5% price increase for any American company purchasing goods or services priced in euros.

This currency shift acts as an immediate 13.5% “surcharge” on the U.S. nuclear industry. Because the United States currently depends on European companies like France’s Orano and Framatome for critical parts and services—such as massive steel forgings and specialized fuel enrichment—all of those euro-priced contracts have instantly become more expensive in U.S. dollars.

This hidden price hike is just one side of the economic pincer. It is compounded by a more direct and obvious cost: a new tax on the very parts the industry needs to import.

2. The Tariff Challenge: A Direct Tax on Essential Parts

A tariff is a tax that a government adds to the price of goods imported from other countries. As of early 2026, the U.S. nuclear industry is being squeezed by a devastating combination of tariffs that “stack” on top of each other.

The Base Tariff: There is an existing 50% tax (under a rule known as Section 232) on certain processed metals used in construction.

The “Stacking” Tariff: A new 10% tax has been placed on goods from key European countries, including nuclear industry leaders like France and Germany. This new tax is scheduled to rise to 25% and is applied on top of the existing 50% tariff for certain crucial metal components.

The most critical insight here is the “non-substitutable” problem. The U.S. currently has no domestic factories capable of producing the ultra-large, nuclear-safety-grade steel forgings required for core components like reactor pressure vessels and steam generator shells. This creates a “compliance trap”: nuclear developers have no choice but to import these parts from suppliers like Framatome in France or Saarstahl in Germany and pay the full, compounding tariff. The only other option is to abandon the project entirely.

These two problems—a stronger euro and steep, stacking tariffs—are not happening in isolation. They are combining to create a much larger crisis for the future of American nuclear energy.

3. The “Policy Pincer”: How the Two Problems Compound

Industry analysts have dubbed this situation the “Policy Pincer.” The currency shift and the tariffs are hitting project budgets at the same time, squeezing them from two different directions and compounding the financial damage.

The table below synthesizes these combined effects on a new nuclear power project.

The Compounding Cost Crisis (January 2026) | Economic Pressure | Impact on a New U.S. Nuclear Project | | :--- | :--- | | 13.5% Stronger Euro | Instantly increases the dollar cost of all essential parts and fuel services purchased from European partners. | | New 25-50%+ Tariffs | Adds a direct, compounding tax on critical steel components that cannot be made in the U.S., inflating construction material costs. |

This pincer is especially damaging to the next generation of Small Modular Reactors (SMRs). These reactors are vulnerable to “death by a thousand cuts” because their modular design uses a higher ratio of smaller, specialized, European-made components like valves, pumps, and piping per megawatt. The combined costs from the currency shift and tariffs are pushing their projected electricity price from a viable “100/MWh”** to a much less competitive **”118–$125/MWh.” This is a critical failure point, as it pushes SMRs beyond the “walk-away price” for hyperscale data center customers, their primary target market.

This dynamic reveals a major contradiction at the heart of the nation’s energy strategy.

4. Conclusion: A Renaissance in Peril?

The central paradox is clear: the U.S. government states it wants a “nuclear renaissance” to generate clean, reliable energy, yet its own trade and economic policies are making it prohibitively expensive to build the necessary reactors. This disconnect between stated goals and practical policy is actively undermining the entire industry.

The key takeaway is that the problem delaying the U.S. nuclear revival isn’t technology or public protest, it’s policy incoherence that is actively choking the industry’s financial viability.

Ultimately, the verdict from industry analysis is stark. By making nuclear construction more expensive, the U.S. is not just slowing the renaissance; it is actively causing its demise. Without a strategic change from policymakers, such as granting tariff exemptions for critical, non-substitutable nuclear components, the current wave of reactor announcements will likely face a wave of cancellations, leaving the American nuclear revival as an ambition rather than a reality.