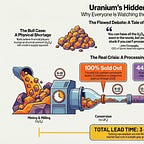

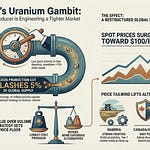

Imagine four players frozen at high noon, guns drawn in a classic Mexican standoff. That’s uranium today. Utilities are burning through fuel inventories, betting miners flood the market. Miners can’t ramp up even if they wanted to. Sprott’s sitting on 75 million pounds and flat-out refuses to sell. Washington isn’t bailing anyone out—it’s building its own stockpile. Worst of all? Even if everyone caved tomorrow, there’s no factory capacity to turn raw uranium into reactor fuel. This isn’t a price game. It’s a slow-motion supply chain trainwreck.

Utilities need steady fuel to keep reactors humming. Right now they’re playing a dangerous bluff, letting inventories drop to 12-18 months from a historical 2-3 years, with some facing 70% uncovered needs for 2027-2030. They’re betting Sprott cracks first, miners cave on price, and “oversupply” magically appears. Except fuel doesn’t materialize overnight—lead times run 3-5 years from mine to reactor rod. By Q2 2026, they’re still delaying contracts. Q3-Q4 brings the first public low-fuel warnings. By Q1 2027, some will sign anything to avoid a blackout. Late 2027, reactor shutdowns loom, and Washington steps in hard.

Miners extract yellowcake and desperately want higher prices to restart operations, but every 2024-2025 restart has missed targets. McArthur River flopped. Kazatomprom just slashed its 2026 guidance 20% below contracts. New greenfield mines? Forget it, 7-10 years minimum through permitting hell, labor shortages, and equipment bottlenecks. Sprott CEO John Ciampaglia put it bluntly: “Uranium mining is not easy. Every brownfield turned back on has had growing pains.”

Subscribe to meet the two players changing everything: Sprott (hoarding 10% of global supply) + the processing crisis nobody sees coming.